Mortgage calculator if i pay extra

Mortgage Payoff Calculator with Extra Payment Recurring Irregular Both Example 3. Determine how much extra you would need to pay every month to repay the full mortgage in say 22 years instead of 30 years.

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Calculator App

Mortgage Calculator zip file - download the zip file extract it and install it on your computer.

. And also how much faster youll pay off your mortgage. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. This is the best option if you plan on using the calculator many times over the.

Join the ranks of debt-free homeowners by getting intense about paying off your home loan. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

30-Year Fixed Mortgage Principal Loan Amount. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interest. But also very powerful.

Check out the webs best free mortgage calculator to save money on your home loan today. Lenders define it as the money borrowed to pay for real estate. You can also use the calculator on top to estimate extra payments you make once a year.

To make it easier you can time this when you get large work bonuses or tax returns within the year. Both the principal and interest amounts decrease over time whether you make payments on the 1st 15th or. The calculator is mainly intended for use by US.

Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. Here are her loan details. The calculator will now show you what your mortgage payments will be.

Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. Pay this Extra Amount. Original Loan Terms Years.

For Excel 2003. Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. Enter your loan information and find out if it makes sense to add additional payments each month.

360 original 30-year term Interest Rate Annual. An additional 50 or even 25 extra principal each month may make a surprising difference. How to Use the Mortgage Calculator.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. There is no best day of the month to pay your mortgage. How to use the mortgage payment calculator.

Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. See alternatives that can help save you money and shorten the life of your loan. To use the calculator start by entering the purchase price then select an amortization period and mortgage rate.

Learn extra strategies to pay off your loan faster. This is the best option if you are in a rush andor only plan on using the calculator today. To use the calculator input your mortgage amount your mortgage.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Blake finds that after every 3 months he has to pay 289220 extra to pay off the loan in the next 10 years. Based on the example the 5-year fixed mortgage with the highest rate is offered to borrowers with 90 LTV which is 305 APR.

Youll also build more. A mortgage is a loan secured by property usually real estate property. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization.

Our calculator includes amoritization tables bi-weekly savings. Use LendingTrees mortgage calculator to estimate your monthly payment and find out how much you can expect to pay for your home. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees.

To pay extra on your mortgage you can make an additional 13th payment. Pay off your mortgage early with these helpful tips. Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022.

Fallon has taken a mortgage loan of an amount for her newly bought home. Even applying an extra 100 to your mortgage every month can save you thousands in interest charges over the life of a 30-year loan. Outlined below are a few strategies that can be employed to pay off the mortgage early.

You can save a lot of interest if you pay down the loan earlyThis extra payment calculator is designed to tell you how much interest and time youll save if you know how much extra you can pay each month. Making extra mortgage principal payments can be beneficial for some homeowners but not for others. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance.

Use Moneys free mortgage calculator to get an estimated monthly mortgage payment based on your loan details. The CUMIPMT function requires the. You can make extra payments regularly or a lump-sum payment toward the mortgage principal to reach that 20.

If you paid an extra 500 per month youd save. Aside from selling the home to pay off the mortgage some borrowers may want to pay off their mortgage earlier to save on interest. Imagine a 500000 mortgage with a 30-year fixed interest rate of 5.

Mortgage Amount or current balance. The calculator shows the best rates available in your province but you can also add a different rate. Early Mortgage Payoff Examples.

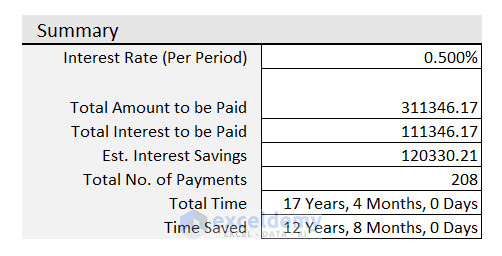

Mortgage insuranceIf your down payment is less than 20 of the cost of your house many lenders will require you to pay an additional fee called private mortgage insurance or PMI. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. Once the user inputs the required information the Mortgage Payoff Calculator will calculate the pertinent data.

But if you reduce your LTV to 80 upon remortgaging you can obtain a 5-year fixed mortgage with 197 APR.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Free Interest Only Loan Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Repayment Calculator

Download A Free Home Mortgage Calculator For Excel Analyze A Fixed Or Variable Rate Mortgage And Inclu Mortgage Loans Financial Calculators Refinance Mortgage

Mortgage Calculator With Extra Payments And Lump Sum Excel Template